student loan debt relief tax credit application for maryland resident

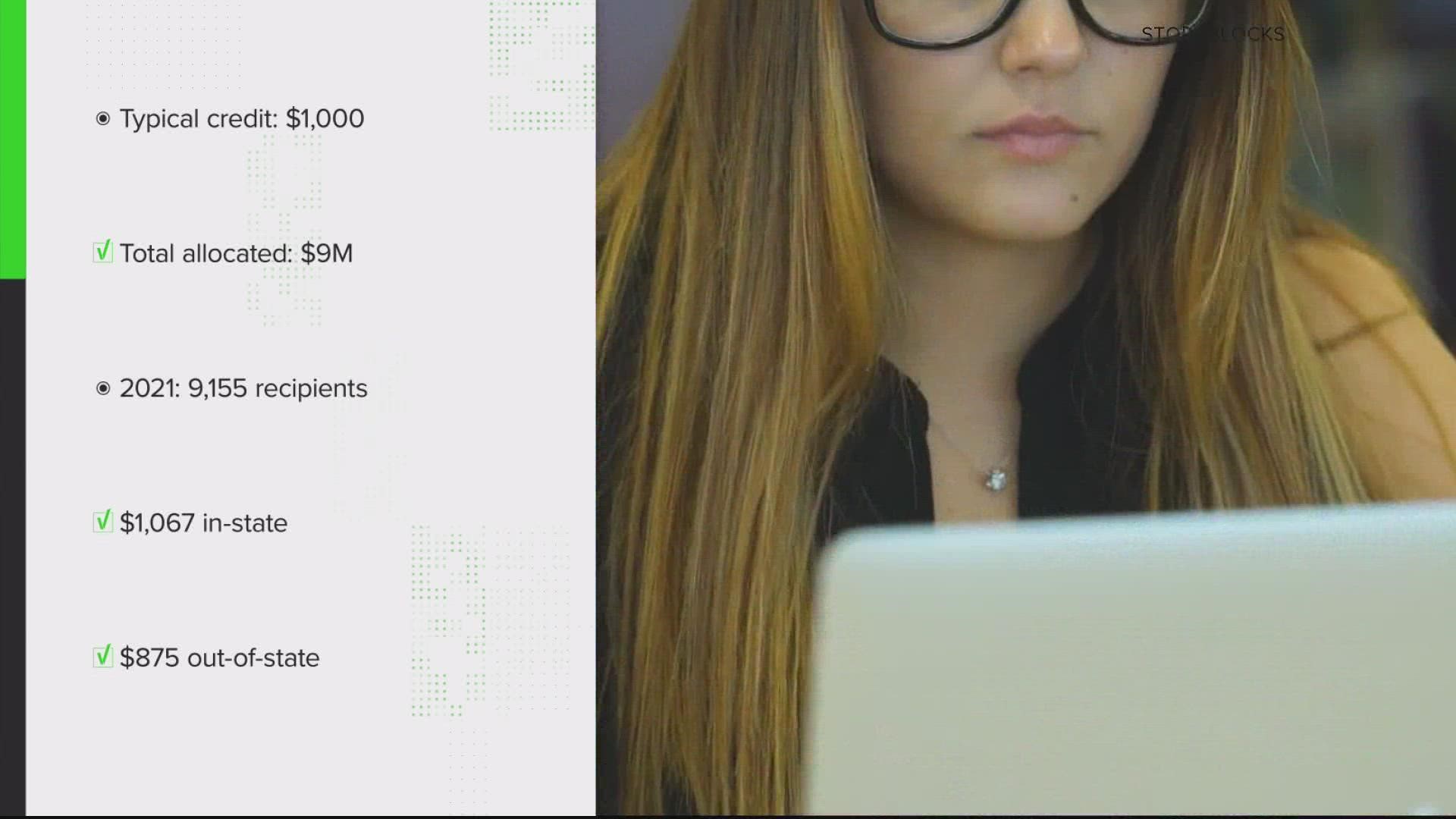

The state is offering up to 1000 in. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017.

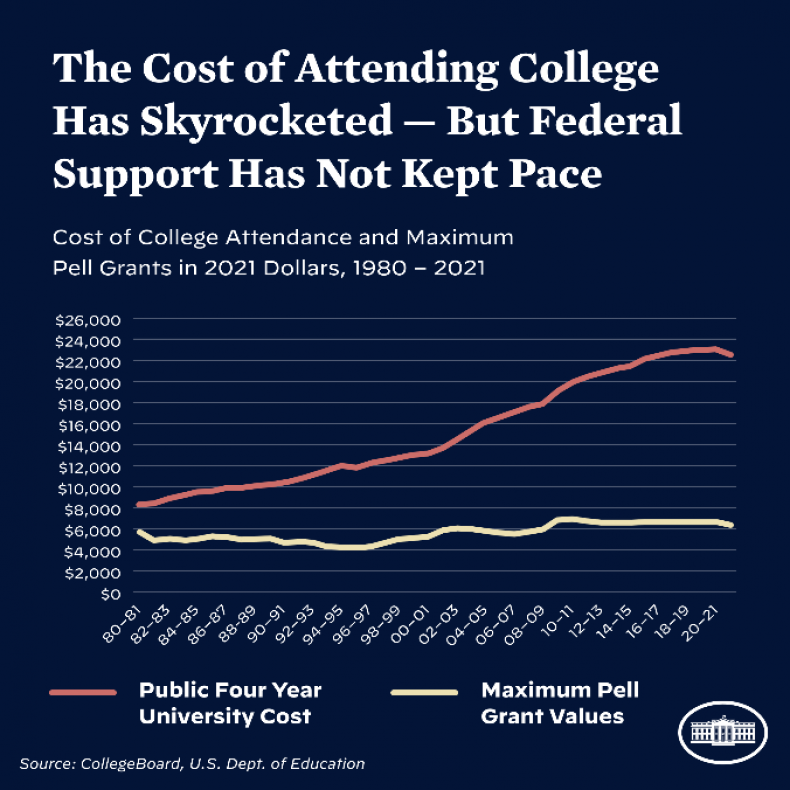

Student Loan Forgiveness May Come With A State Income Tax Bomb

Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

. Eligible people have until Sept. How much money is the Maryland Student Loan Debt Relief Tax Credit. Who wish to claim the Student Loan Debt Relief Tax Credit.

Otherwise recipients may have to repay the credit. The state is offering up to 1000 in tax credits for student loan. Eligible Individuals have until Sept.

With more than 40 million distributed through the program. Maryland residents looking to claim student loan debt relief must do so in less than two weeks. 1 day agoResidents have until Thursday Sept.

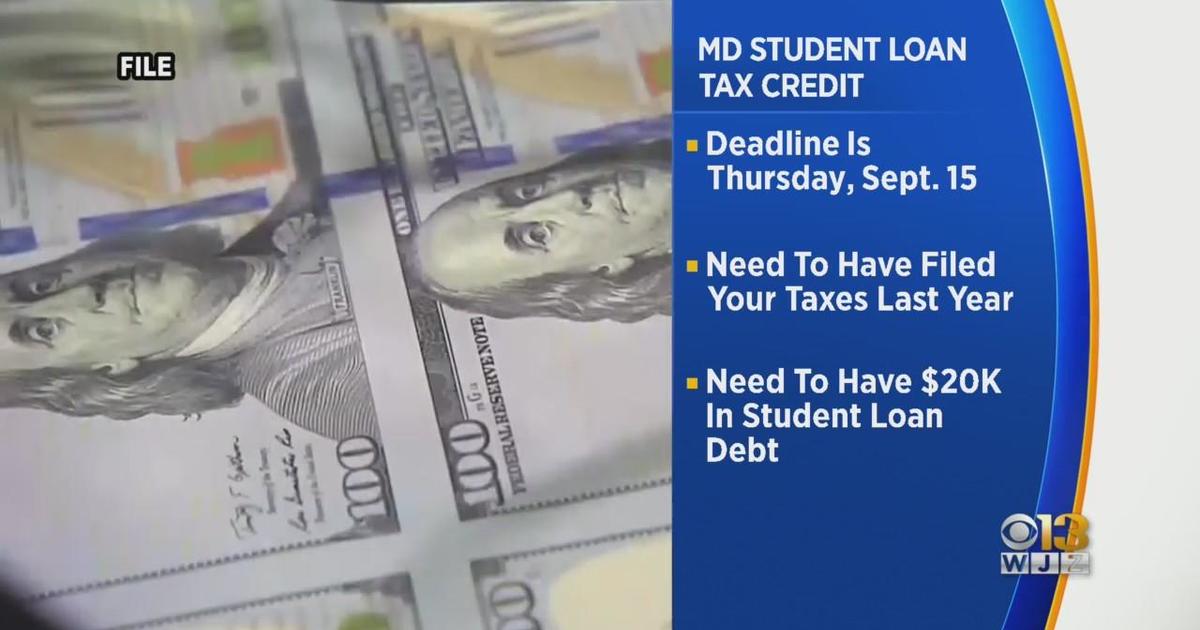

1 day agoYou must claim Maryland residency for the 2022 tax year. The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit Program for 2022. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Instructions are at the end of this application. 2 days agoFour million student-loan borrowers in California wont have to worry about taxes on their debt relief. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans.

State Comptroller Peter Franchot says these persons can apply for the. 1 day agoThe program provides an income tax credit to residents making payments on loans from an accredited college or university. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

15 to apply for a Student Loan Debt Relief Tax. Annapolis Md KM Maryland residents who are burdened by student loan debt can get some relief. Student Loan Debt Relief Tax Credit Application.

Credit for the repayment of eligible student loans. For Maryland Residents or Part-year Residents Tax Year 2020 Only. Marylanders are eligible if they file their taxes have incurred at least 20000 in student loan.

If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Complete the Student Loan Debt Relief Tax Credit application. More than 40000 Marylanders have benefited from the tax credit since it.

The deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming in less than three weeks. Applications close Thursday for Maryland Student. September 14 2022 757 pm.

After President Joe Biden announced up to 20000 in student-loan. To qualify you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. This tax credit is given to help students offset some of their.

15 to submit an application for Tax Year 2022. There isnt a set amount thats released for the. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code.

More Student Loan Relief Here S How Marylander Taxpayers Can Apply Wusa9 Com

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

The Elm Maryland Student Debt Relief Tax Credit Apply By Sept 15

Indiana To Tax Student Debt Relief

What Is Maryland Student Loan Debt Relief Tax Credit Statanalytica

President Biden Expected To Announce Student Loan Debt Relief

Indiana Mississippi And North Carolina Will Tax Your Canceled Student Loan Debt Cnet

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wjla

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

How To Apply For Maryland S Student Loan Debt Relief Tax Credit Central Scholarship

Tax Credit 2022 Deadline For Marylanders To Claim 1 000 Student Debt Relief In 13 Days Washington Examiner

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Comptroller Of Maryland Facebook

Apply For Maryland S Student Loan Tax Credit Are You A Maryland Resident With Student Loans Then You Should Apply For Maryland S Student Loan Tax Credit Here S A Quick Guide To Walk

Ultimate Guide Student Loan Forgiveness For Accountants Student Loan Hero